The Hidden Costs of Zero Interest Solar Finance: Unveiling the Truth

In today’s world, where renewable energy is gaining traction, many finance companies offer zero interest loans for solar installations. On the surface, this may seem like an excellent deal. However, it’s crucial to understand the real cost behind these offers. When a solar sales representative presents you with zero interest solar finance, what are the hidden implications? Let’s cut to the chase and uncover the truth.

The Sneaky Reality of Zero Interest Finance

While the concept of zero interest may sound appealing, the truth is that you could end up paying significantly more for your solar system. In fact, some companies charge as much as 28% more, including accounting and upkeep fees. How is this possible? The answer lies in the way these companies structure their financing arrangements.

In reality, these companies charge the solar installation company by deducting the interest from their final settlement amount. This means that the installation company may cut costs during the installation process, resulting in a cheaper and potentially less reliable system for you as the customer. Ultimately, the costs are still passed down to you in some way or another.

The Surprising Price Difference

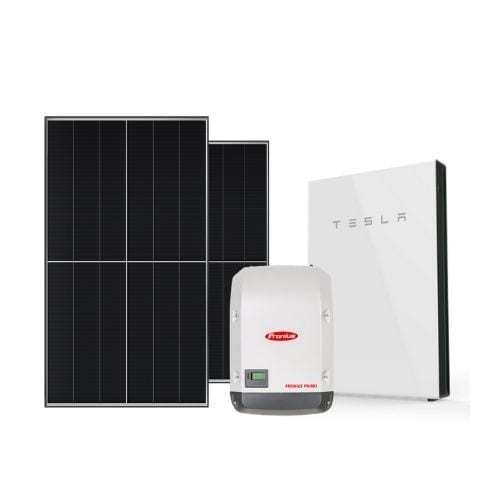

Now, let’s consider how much extra you could end up paying with zero interest solar finance. The average cost of a decent solar and battery system ranges from $25,000 to $35,000. With rising energy costs and the increasing necessity for solar power, many people feel compelled to pursue financing options to avoid higher electricity bills.

Here’s where the sharks start circling, offering seemingly attractive “zero interest loans.” However, if you opt for such financing and end up paying 25% additional interest or fees upfront, your solar system could cost you an extra $7,500 or more compared to paying cash or securing a low-interest loan. While the salesperson may tell you that the repayments will be less than your bill, choosing the right finance loan can significantly reduce your costs even further.

The Legal Gray Area

You might be wondering if this practice is even legal. Well, it’s barely legal. Many finance companies shift most of the liability concerning Australian Consumer Law onto the solar installer. From the finance company’s perspective, the solar installer is essentially a third-party entity that closes deals on their behalf. However, the solar installer is not allowed to offer financial advice or discuss the loan’s terms, posing a challenge for all parties involved.

Moreover, retailers are prohibited from having two separate prices, one for “zero interest” and one for cash payments. This puts the installer in a precarious position. If they quote you a cash price and you suddenly opt for a zero interest loan, they could lose 25% of the invoice amount.

Why Does This Happen?

The solar industry is highly competitive, and many companies operate on thin profit margins. A 25% loss is not something most companies can absorb, nor should they have to. They need to make enough profit to execute the job properly without cutting corners, which is the last thing you want when it comes to your solar installation.

There have been cases where customers arranged their own finance and were given the option of zero interest by the financier. However, the installer received a shock when the invoice fell short by 25%. This situation can lead to legal complications, as it is challenging to determine who is at fault.

The Best Finance Options For Solar

As solar installers, we are not licensed financial advisors, which makes navigating the finance landscape a bit tricky. However, based on our observations, companies offering low-interest loans often work out to be cheaper than those offering zero interest. Additionally, exploring potential equity from your home or utilizing an offset account can be advantageous. Home loans generally offer the lowest interest rates, so if you can refinance or borrow against your house, you may secure the best deal.

Conclusion

When it comes to financing your solar installation, it’s crucial to question any “zero interest” offerings and compare them against other companies that provide cash prices. While the allure of zero interest may be enticing, it’s essential to consider the potential hidden costs and make an informed decision. Conduct your own research, consult with financial professionals, and explore different financing options to ensure you secure the most cost-effective solution for your solar journey.

Share With Your Friends!

About your author...

Luke Cove

On a mission to electrify Australia. Luke is known for being at the forefront of his industry offering design, supply, installation and advice on solar panels, solar batteries, lighting, electric vehicles and chargers.

Luke has been known to invest most of his time (and money) in helping people create and experience new lifestyles through clean energy at home, business and with their cars. As well as investing his time training the next generation of climate enthusiasts through his team at Lightning Energy.