Zero Interest Solar Finance: Don't Get Stung with a Dodgy Deal!

Many finance companies offer zero interest loans for solar. But if something sounds too good to be true, is it?

So when a solar sales rep comes into your home or office and offers zero interest solar finance, what is the real cost?

Well let’s cut to the chase here, if you’re signing up to solar & or battery with zero interest you are probably paying at least 20% more, with some companies charging 28% more plus accounting and upkeep fees.

But how? I thought it was zero interest I hear you ask. Here’s the sneaky part. What these companies do is actually charge the solar installation company by deducting the interest from their final settlement amount.

This may result in the installers cutting costs in the installation leaving you with a cheaper, less reliable system. Ultimately, the cost will still get passed back down to you somewhere down the line.

So How Much Extra Will You Be Paying?

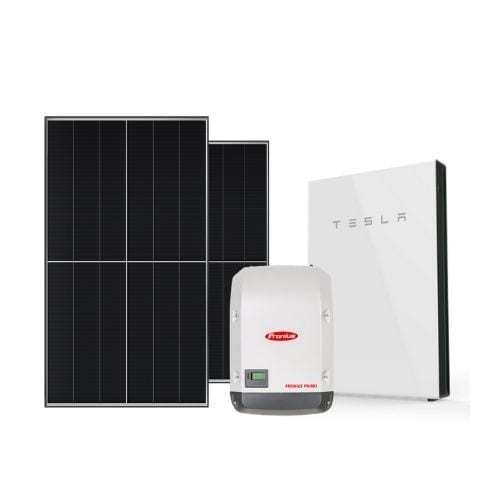

With the average cost of a decent solar + battery system sitting between $25,000 to $35,000 these days, it’s not surprising that not everyone has that money laying around.

Not only that, but with rising energy costs most people no longer see solar as an option, but more of a necessity for their homes.

For good or bad, a lot of people feel “pushed” into solar by these high energy prices and are prepared to take up finance to avoid paying higher electricity bills.

This is where the sharks begin to circle offering “zero interest loans”. So, if your system is $30,000 and you’re paying 25% additional interest (or fees) upfront, your system could be costing $7,500 or more than if you opted to pay cash or got a low interest loan.

The salesman will tell you “the repayments are less than your bill” which may be true, but they could be a whole lot less again if you choose the right finance loan.

Is This Even Legal?

Well, barely. Many finance companies get around this by pushing most of the liability around Australian Consumer Law onto the solar installer, which is essentially a third party company to them that goes in and closes the deal on their behalf.

However the solar installer isn’t allowed to legally offer financial advice about the loan, or technically financial advice at all, which is another touchy topic since they are essentially offering you a 25 year investment, but we won’t get into that today.

It‘s actually illegal for a retailer to have two separate prices, one for “zero interest” and one for paying cash. So the installer is really in a tricky position if they quote you a cash price, and at the last minute you decide you want a zero interest loan and then know they are going to lose 25% of the invoice.

Why Does This Happen?

The solar industry is very competitive and most companies are operating on very small net margins, a 25% loss is not something most companies can absorb, nor should they have to, as they need to make enough money to do the job properly without cutting corners, which is really the last thing you want.

There have also been cases where customers have organised finance themselves and been given the option of zero interest from the financier and then the installer has received a shock when the invoice is short 25%.

Can you imagine putting in an offer for a 1 million dollar house, getting finance and rocking up to settlement and the bank has only given you 900k but charged you 1 million and you’re expecting the keys to the house?

This can open up all 3 parties to all kinds of legal issues down the track and it is very difficult to decide who is at fault.

Zero interest through Energy retailers

While the allure of zero-interest financing for solar installations offered by energy retailers may sound like a good deal, it’s crucial to scrutinize the underlying intricacies. Opting for this seemingly advantageous deal often leads to unintended consequences.

Many times, it entails being tethered to a contract with unfavorable terms. In some instances, you might find yourself enrolled in a Virtual Power Plant (VPP) program, where the energy retailer has the authority to draw power from your battery at their discretion. This could potentially leave you high and dry during critical moments like a blackout.

What’s more, in certain cases, you might not even own the panels installed on your roof, introducing a layer of complexity and potential ownership disputes down the line. It’s imperative to consider these factors before committing to what may initially seem like a cost-effective solution.

Why Does This Happen?

At the end of the day, we are solar installers. We aren’t licensed financial advisors, so it’s a bit of a minefield when offering finance. From what we have seen, companies offering “low interest” loans nearly always work out cheaper than “zero interest”.

Another thing to consider may be looking at any potential equity you can use from your home or an offset account, home loans are generally the lowest interest you can get. If you can refinance or borrow against your house you’ll probably get the best deal.

Of course, I strongly recommend you do your own research here, just please make sure you question any “zero interest” offerings and price check them against another company that is offering a cash price.

Already sorted your plan for solar? Check out our range!

Share With Your Friends!

Written By:

Luke Cove

Managing Director

Lightning Solar & Electrical